Since 1993

Stocks are complicated, let's simplify things

We at The Upside List are everyday investors like you, just trying to keep an eye on a small handful of stocks with long-term upside over the next few years. The only problem is...there is so much financial news and information out there that we know can be hard to digest it all!

It is a struggle sorting through all the financial data and analysis of the 3,000+ publicly-traded U.S. companies, to find a just a few that might be nearing their price bottom. It's for everyday investors like you why we created The Upside List.

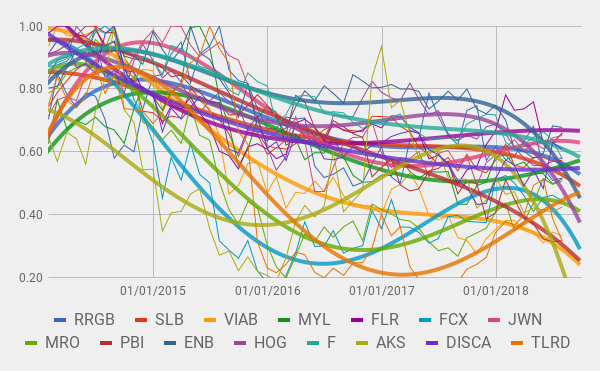

Our team highlights and publishes a monthly list of 8-15 stocks, based on a set of our simple "Upside" rules. Then, we track and chart these stocks over the long-term so that you can understand the bigger picture, and have better discussions with your investment advisors.

Before you take action, note that The Upside List team are not investment advisors, or are otherwise providing investment advice to you. See our Legal Disclaimer page for our terms and conditions for use of this site.

Upside Rule #1 - Buy near the Low, not near the High

It's no big secret: it's better to buy stocks at their lows - not their highs. We ignore stocks that "pop" or make a multi-year highs. Instead, we start tracking a company for years after it hits a rough patch, far off of its historical high.

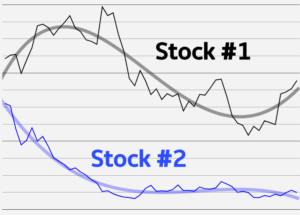

Upside Rule #2 - Track the Trends of each Stock

Stocks can be volatile and have a lot of price fluctuation and "random walk". We smooth out the small, noisy movements in price to find the overall direction a stock is heading over many years using a curve fit.

Upside Rule #3 - Normalize all Curves to a Set Scale

Price, earnings, market cap. These are all absolute numbers. What if we only compared the stocks at their lows with other stocks by ratios of this financial data?

Next Steps...

This is should be a prospective customer's number one call to action, e.g., requesting a quote or perusing your product catalog.